A Quick Guide to Unicharm

(Chapter 3: Unicharm’s objectives)

Unicharm’s objectives

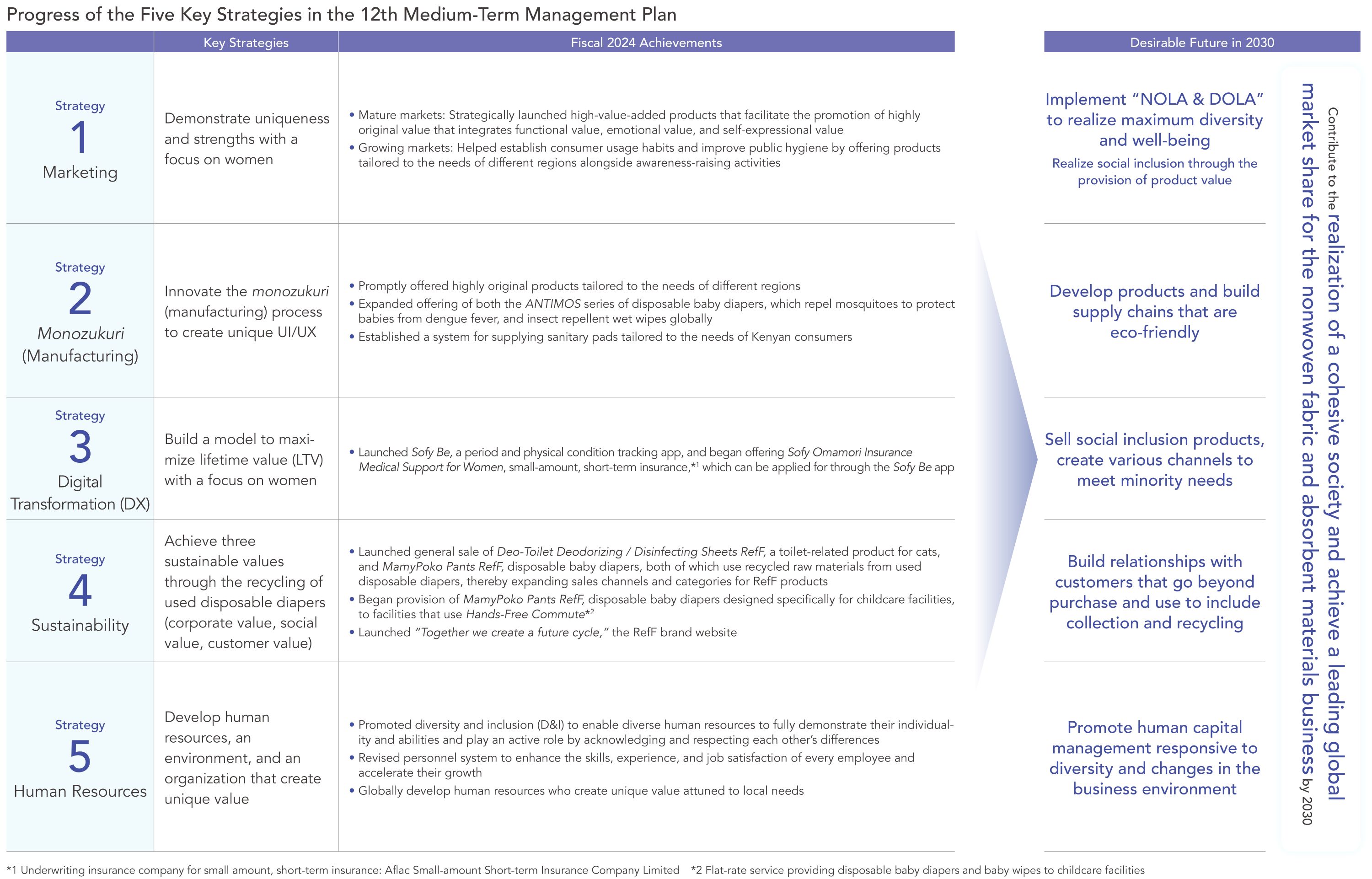

The 12th Mid-term Management Plan(FY2024-FY2026)

Today, rising income levels, primarily in Asia, are prompting an expansion of the middle class and an increase in disposable incomes among women. As the advancement of women in society progresses, Unicharm expects similar circumstances to proliferate in the Middle East and Africa, as well as Asia, realizing a global future of consumer trends driven by women.

In light of these changes, the Company’s latest medium-term management plan, the 12th MediumTerm Management Plan, Project-L, which got underway in fiscal 2024, will build a foundation for Unicharm to grow to become the world’s best company, symbolizing the advancement of women, by capturing megatrends in relation to women, who have a natural affinity with its business activities.

The L in Project-L incorporates the three concepts of Lady, Life, and Love.

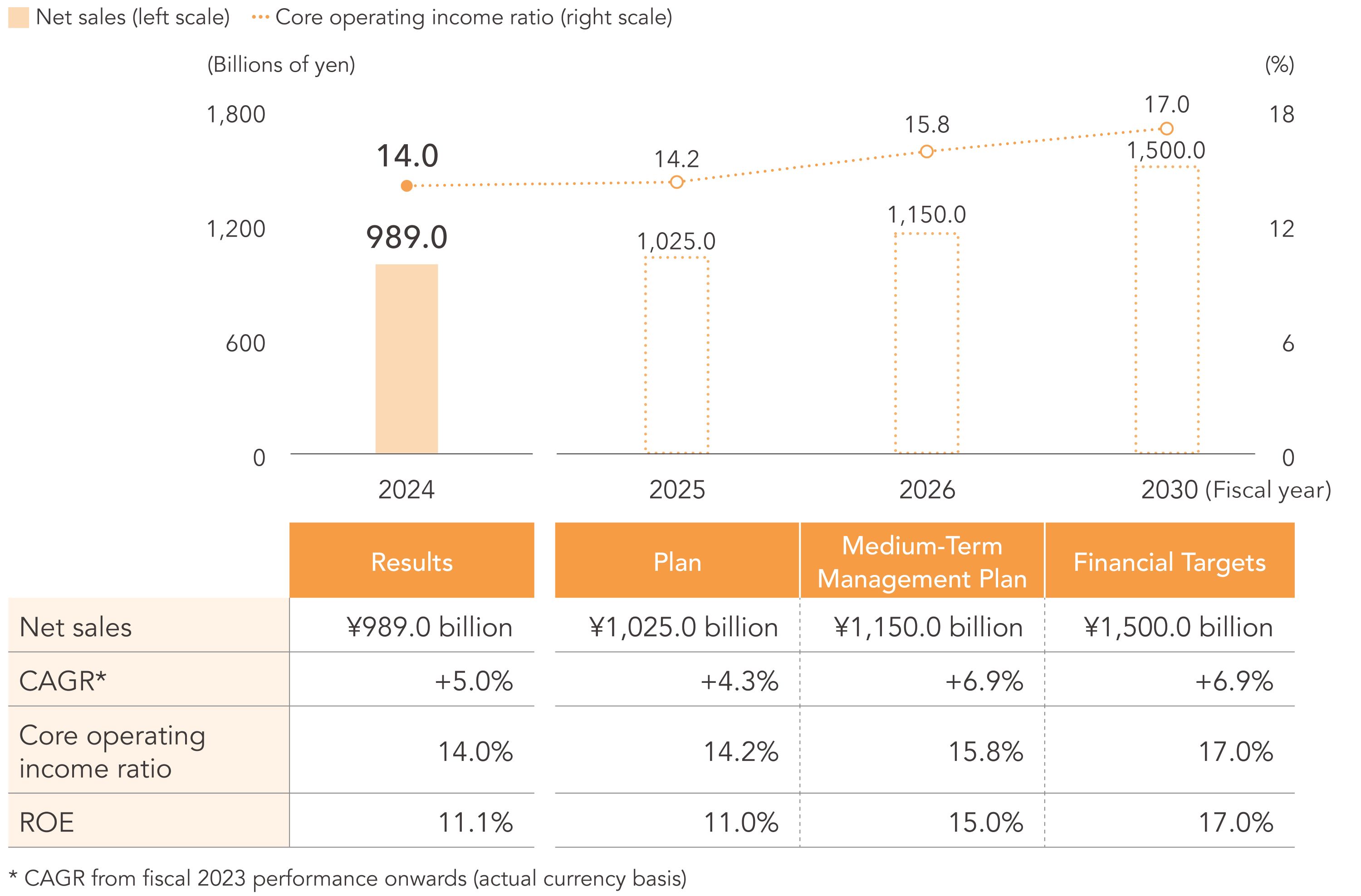

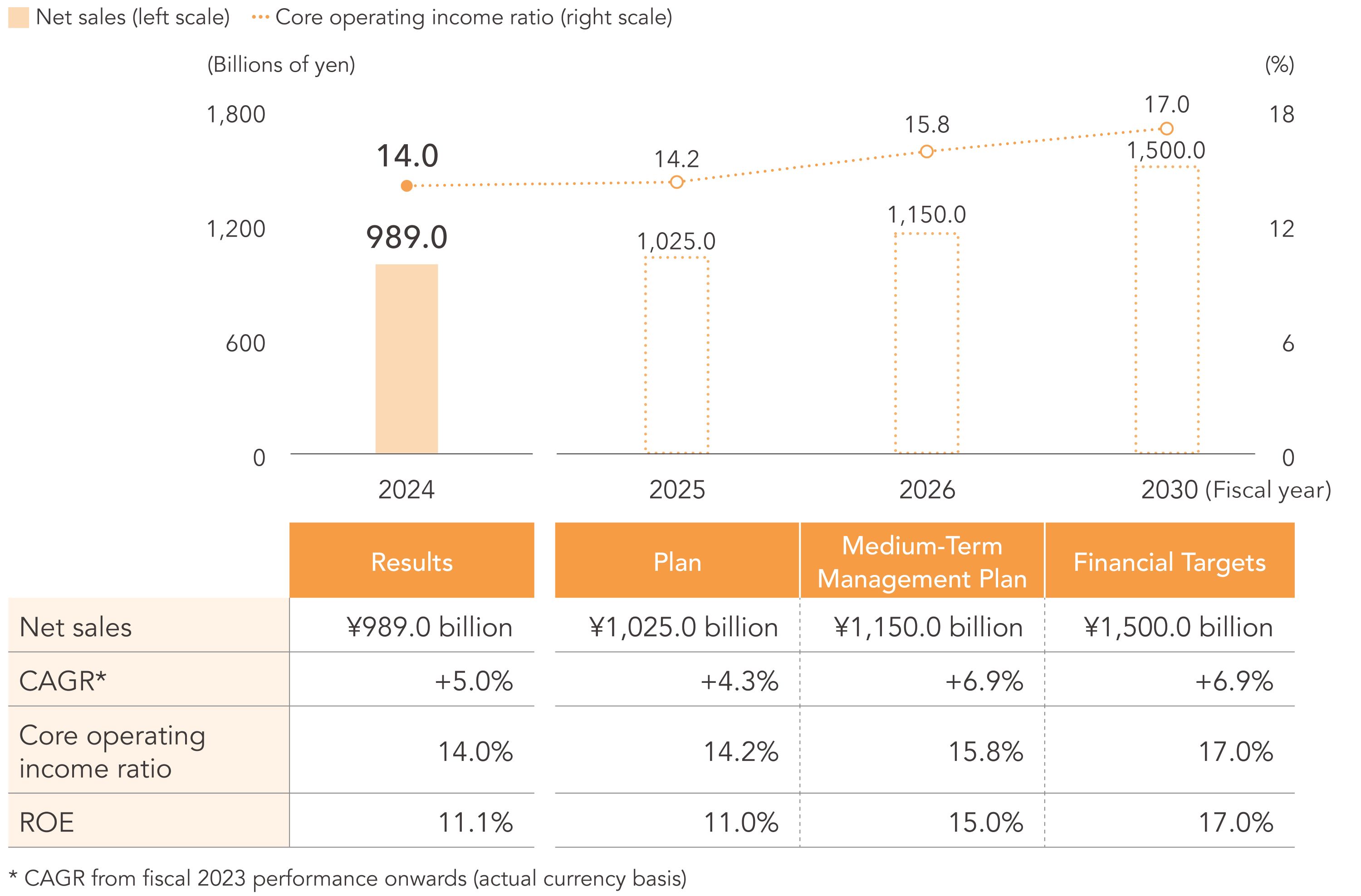

Unicharm will aim for net sales of ¥1,150.0 billion in fiscal 2026 by creating and focusing on products and services for women during the three years between fiscal 2024 and fiscal 2026, maximizing the lifetime value of all people and pets throughout the world under a basic policy of enhancing the Company’s relative value and helping realize a cohesive society.

- Click on the screen for a larger view.

Financial Goals and Results of the 12th Medium-Term Management Plan

Our goal is to become the global No. 1 in market share in the nonwoven fabric and absorbent material business by 2030. To achieve this, we must deliver a CAGR of approximately 7% while enhancing profitability and efficiency to realize a core operating profit margin and ROE of 17%.

Under the 12th Medium-Term Management Plan, we have set targets of a 6.9% CAGR, net sales of ¥1.15 trillion, a core operating profit margin of 15.8%, and an ROE of 15.0% for fiscal 2026.

To achieve these numerical targets, we must not only strengthen our financial base but also make strategic investments essential for sustainable growth. Recognizing that strategies tailored to the growth stages of each country, region, and category, along with appropriate ROI management, are critical to improving ROE, we have worked to enhance profitability using KPIs such as gross profit margin. Going forward, we will monitor KPIs that contribute to ROIC improvement, enabling more precise management and delivering performance that meets the expectations of our shareholders and investors.

To advance proactive business strategies, we believe it is important to strengthen our ability to generate operating cash flow, thereby enabling us to continue investing for growth while maintaining a balance with shareholder returns.

Regarding shareholder returns, we have set a basic policy of maintaining a total return ratio of 50% as one of our top priorities and plan to exceed 50% in fiscal 2025. We also plan to raise the dividend payout ratio from 30% to 35% and achieve 24 consecutive years of dividend increases. Share buybacks will be carried out flexibly as necessary, with the aim of enhancing capital efficiency and shareholder value.

Going forward, we will continue to combine stable and continuous dividends with agile share buybacks, working to build a strong, trust-based relationship with our shareholders.