The following is the status of the company stocks as of December 31, 2024:

| Securities code | 8113 |

|---|---|

| Listed Stock Exchange | Prime Market of Tokyo Stock Exchange |

| Number of common stocks issued | Total number of stocks authorized:827,779,092 |

| Total number of shareholders | 56,907 people |

| Number of stocks per trading unit | 100 stocks |

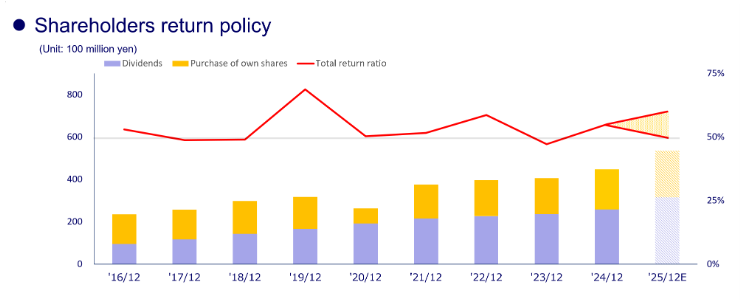

Shareholders return policy

Our company recognizes the return of profits to shareholders as one of the highest priorities in our management strategy. While placing significant emphasis on business investments that will drive sustainable growth, we are committed to delivering stable and continuous dividends based on medium- to long-term consolidated financial performance. Additionally, we will flexibly implement share buybacks as necessary, with the objective of achieving a total return ratio of 50%. For the fiscal year 2025, after carefully considering the prevailing market conditions and our financial standing, we plan to exceed a 50% profit return ratio.

With regard to the dividend payout ratio, we have raised our target from the previous 30% to 35%, and we are planning to achieve the 24th consecutive year of dividend increases. Furthermore, we will continue to strategically conducting share buybacks in order to enhance capital efficiency and further increase shareholder value.

Looking ahead, we will continue to pursue both stable and progressive dividend increases alongside share buybacks, maintaining the return of profits to shareholders as a central tenet of our management policy. We remain resolutely committed to enhancing corporate value through the generation of sustainable cash flows.

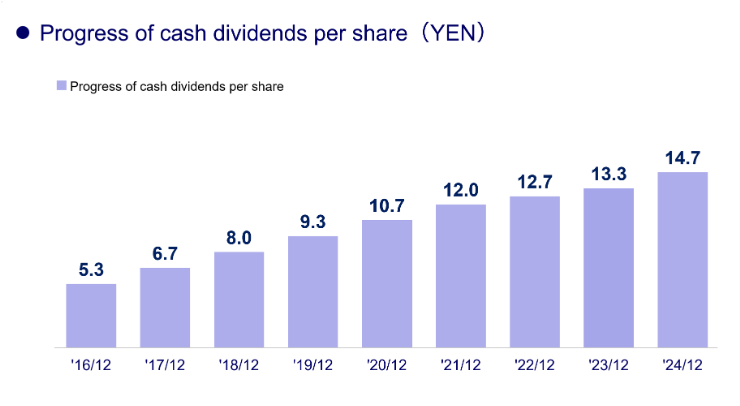

| Progress of cash dividends per share | 2020/12 |

2021/12 | 2022/12 | 2023/12 | 2024/12 |

|---|---|---|---|---|---|

| (yen) | 10.7 | 12.0 | 12.7 | 13.3 | 14.7 |

Progress of cash dividends per share

As of January 1st, 2025, Unicharm conducted a stock split at a ratio of 3 shares per common share. Figures show amounts converted to the post-stock split basis.

| Progress of cash dividends per share | 2020/12 |

2021/12 | 2022/12 | 2023/12 | 2024/12 |

|---|---|---|---|---|---|

| (yen) | 10.7 | 12.0 | 12.7 | 13.3 | 14.7 |

Major shareholders

The following is the status of the company stocks as of December 31, 2024:

| Major shareholders (Top 10) | Number of shares held ('000) | Ratio of shareholding (%) |

|---|---|---|

| UNITEC CORPORATION. | 154,957 | 26.4 |

| THE MASTER TRUST BANK OF JAPAN, LTD. (TRUST ACCOUNT) | 63,751 | 10.9 |

| TAKAHARA FUND LTD. | 28,080 | 4.8 |

| CUSTODY BANK OF JAPAN LTD. (TRUST ACCOUNT) | 24,153 | 4.1 |

| THE IYO BANK, LTD. | 15,300 | 2.6 |

| NORTHERN TRUST CO. (AVFC) RE UKUC UCITS CLIENTS NON LENDING 10PCT TREATY ACCOUNT | 12,355 | 2.1 |

| NIPPON LIFE INSURANCE COMPANY. | 12,189 | 2.1 |

| JP MORGAN CHASE BANK 385632 | 10,501 | 1.8 |

| STATE STREET BANK AND TRUST COMPANY 505001 | 8,132 | 1.4 |

| THE BANK OF NEW YORK MELLON AS DEPOSITARY BANK FOR DEPOSITARY RECEIPT HOLDERS | 8,044 | 1.4 |

- The number of shares was rounded off for shareholdings less than 1,000

- The shareholdings ratio was calculated by deducting treasury shares (34,464,582) shares

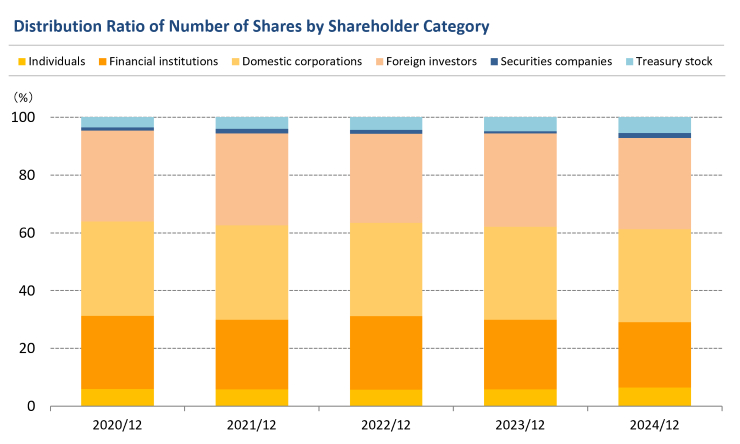

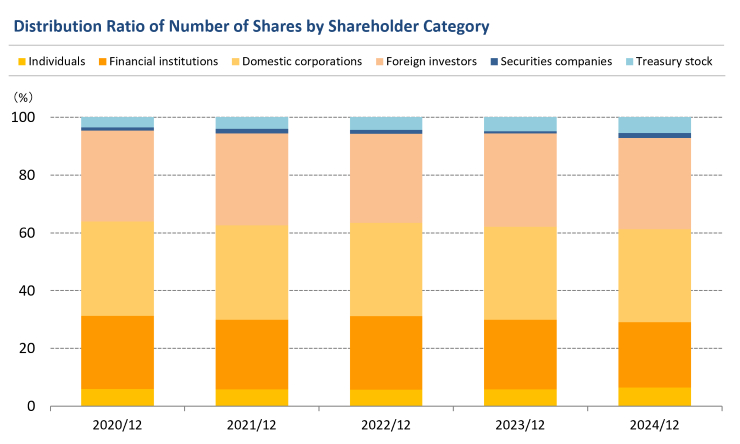

Distribution Ratio of Number of Shares by Shareholder Category

| Distribution Ratio of Number of Shares by Shareholder Category |

2020/12 |

2021/12 | 2022/12 | 2023/12 | 2024/12 |

|---|---|---|---|---|---|

| Individuals | 6.0% | 5.9% | 5.8% | 5.8% | 6.4% |

| Financial institutions | 25.3% | 24.1% | 25.4% | 24.1% | 22.6% |

| Domestic corporations | 32.6% |

32.6% | 32.3% | 32.2% | 32.2% |

| Foreign investors | 31.5% | 31.9% | 30.8% | 32.3% | 31.5% |

| Securities companies | 1.1% | 1.6% | 1.3% | 0.7% | 1.7% |

| Treasury stock | 3.5% | 4.0% | 4.4% | 4.9% | 5.6% |

| Fiscal Year | Commencing January 1 each year and ending on December 31 of each year |

|---|---|

| Closing date of Register of Shareholders / For Ordinary General Shareholders Meeting, and dividend payment |

December 31 |

| For interim dividend payment | June 30 |

| Ordinary General Shareholders Meeting | Late in March of each year |

Share Registration Agent The Firm Responsible for Administering Special Account |

Mitsubishi UFJ Trust and Banking Corporation |

| Independent Auditor | PricewaterhouseCoopers Aarata LLC |

| Dividend Payment | Please collect the dividend at your local Post Office during the designated period. (Those who specified a bank transfer will have the dividend transferred into the designated account). Note that it is possible to receive the dividend by bank transfer. Those wishing to use this service should request a Dividend Transfer Form from Mitsubishi UFJ Trust and Banking Corporation. |

Administrative Procedures Regarding Shares

・Please inform the securities firm at which you hold an account of changes of address, demands for sales and purchases of fractional shares or other various services.

・Any unpaid dividends shall be paid out by Mitsubishi UFJ Trust and Banking Corporation, which is the administrator of Advantest's shareholder registry.

ADR

In addition to common shares, our ADRs are traded over-the-counter (OTC) in the U.S. (Depositary Bank: The Bank of New York Mellon) Please click here for The Bank of New York Mellon's ADR website.

| Type of ADR program | Sponsored Level I program |

|---|---|

| Trading market | OTC(Over-The-Counter) |

| ADR ratio | 2 ADRs = 1 share of common stock (2:1) |

| CUSIP number | 90460M204 |

| Ticker symbol | UNICY |

| Depositary bank | The Bank of New York Mellon |

| Local custodian | Mizuho Bank, Ltd. |